Internet Access: A Changing of the Guard

By Lexa Bauer, Technical Content Manager, Avid Gamer

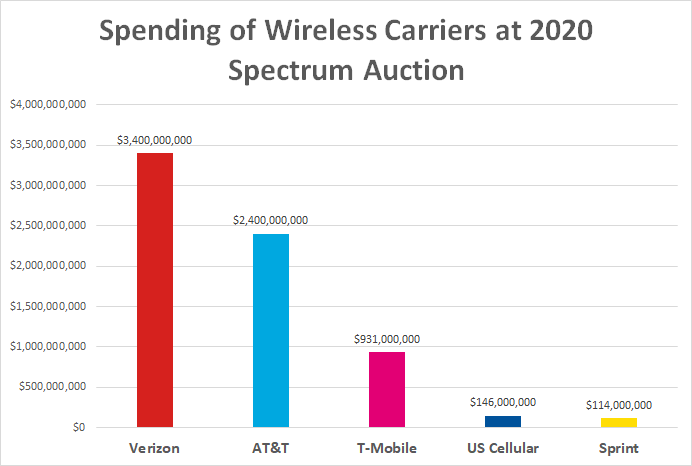

At the largest Spectrum auction to date in 2020, service providers spent $7.6 billion in total for spectrum licenses in the upper 37 GHz, 39 GHz, and 47 GHz band. Five of the top six spenders, who comprised 92% of the total spending, are wireless carriers.

At the largest Spectrum auction to date in 2020, service providers spent $7.6 billion in total for spectrum licenses in the upper 37 GHz, 39 GHz, and 47 GHz band. Five of the top six spenders, who comprised 92% of the total spending, are wireless carriers.

With wireless carriers rolling out Fixed-Wireless Access networks, this represents a potential changing of the guard in terms of where consumers get their internet. Cable companies have long held a monopoly on internet access in many regions — a Nokia report found that 41% of consumers have only one option for broadband. This allows them to charge what they want and give little thought to quality of connection or customer service.

This is reflected in the Net Promoter Scores of the largest cable carriers in the United States. A Net Promoter Score is a simple difference between the percentage of satisfied and unsatisfied customers. Scores can range from -100 to 100 with positive values representing more customers satisfied than unsatisfied.

NPS scores vary depending on source and change over the course of time, but Comparably.com and Customer.guru put the NPS of the top cable companies — Comcast, Cox, Charter, Spectrum, and CenturyLink — well into the negatives with a calculated average of -36. On the FWA side, Verizon, AT&T, T-Mobile, US Cellular, and Sprint combine for an average of +7, a 43 point swing in terms of customer happiness.

What does this ultimately mean?

A recent report by PriceWaterhouseCoopers found that 32% of all customers would stop doing business with a brand they loved after one bad experience, with that number jumping to 50% with several bad experiences. Furthermore, Nokia research found that 76% of mobile customers in the US, UK, and South Korea find 5G FWA to be appealing with 66% willing to switch from their cable provider if the cost is the same with FWA. When you add in that nearly half of customers don’t have any other options, it’s plain to see that these customers are eager to see what FWA can provide.

“When it’s too tough for them, it’s just right for us.”

– Former Buffalo Bills coach Marv Levy

FWA has significant deployment cost advantages over wired alternatives. The Department of Transportation puts the cost of laying fiber at $27,000 per mile. Other estimates put the cost at $1 to $6 per foot, or $5,280 to $31,680 per mile with the cost of wiring a 100-200 unit MDU at $15,000-$30,000. mmWave FWA, in particular, has the capacity to serve MDU buildings which comprise a major portion of US households. By facilitating mmWave signal propagation outdoors and penetration indoors, Pivotal’s mmWave repeaters minimize gNB installations and associated costs, while maximizing mmWave service coverage.

Pivotal’s mmWave product ecosystem was developed with end-user satisfaction in mind. For example, the Echo 5G™ subscriber unit is self-installable – no waiting during a 4 or 8 hour window for a technician to show up. And with Pivotal’s Intelligent Beam Management System (IBMS), a lot of troubleshooting can be taken out of the customer’s hands. When it comes to home internet devices, most customers want to set it and forget it with customer troubleshooting largely limited to power cycling or returning the device. (65% of returned broadband devices have no issues.)

All this adds up to a favorable market for FWA to supplement, or even replace current subscribers’ home internet.